A budget is a plan for how you will spend your money. It can help you to track your spending, save money, and reach your financial goals. Here are the steps on how to create a budget:

- Track your spending. This will help you to see where your money is going. You can use a budgeting app or simply track your spending in a notebook.

- Set financial goals. What do you want to achieve with your money? Do you want to save for a down payment on a house? Do you want to pay off debt? Once you know what you want to achieve, you can start to create a budget that will help you reach your goals.

- Estimate your income and expenses. How much money do you earn each month? How much money do you spend each month? Once you know your income and expenses, you can start to create a budget that will help you balance your spending with your income.

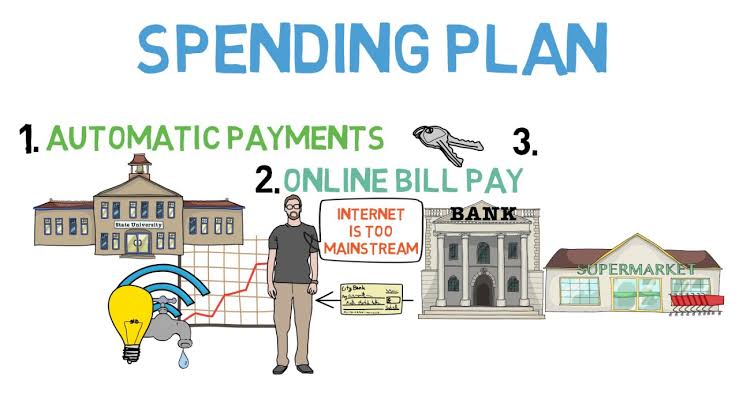

- Create a spending plan. This is where you will allocate your money to different categories, such as housing, transportation, food, and entertainment. Be realistic about your spending and make sure that you are allocating enough money to your essential expenses.

- Stick to your budget. This is the most important step. It can be difficult to stick to a budget, but it is important to be disciplined and to make sure that you are not overspending.

If you follow these steps, you will be well on your way to creating a budget that will help you to take control of your finances.

How to Save Money

Saving money is important for a number of reasons. It can help you to:

- Pay for unexpected expenses. Things happen, and sometimes you will need money for something that you didn’t plan for. Having a savings account can help you to cover these unexpected expenses without going into debt.

- Reach your financial goals. Do you want to buy a house? Do you want to retire early? Saving money can help you to reach your financial goals.

- Reduce your stress. When you have money in the bank, you will feel less stressed about your finances. You will know that you have a financial cushion to fall back on if something unexpected happens.

Here are some tips on how to save money:

- Create a budget. This will help you to track your spending and see where you can cut back.

- Set financial goals. This will give you something to work towards and make saving money more motivating.

- Automate your savings. This will make it easy to save money without even thinking about it.

- Cut back on unnecessary expenses. Do you really need that daily coffee? Could you cook more meals at home instead of eating out? There are a lot of ways to cut back on unnecessary expenses.

- Find ways to make extra money. If you are struggling to save money, you may need to find ways to make extra money. There are a number of ways to do this, such as getting a part-time job, starting a side hustle, or selling unwanted items.

Saving money can be difficult, but it is important to remember that even small amounts of money can add up over time. So start saving today and you will be on your way to a brighter financial future.

How to Pay Off Debt

Debt can be a major burden. It can make it difficult to save money, reach your financial goals, and even enjoy life. If you are struggling with debt, there are a number of things you can do to get out of debt and take control of your finances.

- Make a list of all of your debts. This will help you to see how much debt you have and what your interest rates are.

- Prioritize your debts. Start by paying off your debts with the highest interest rates first. This will save you the most money in the long run.

- Create a debt repayment plan. This will help you to track your progress and stay motivated.

- Make more than the minimum payments. This will help you to pay off your debt faster

- Avoid using credit cards. Credit cards can make it easy to overspend and get into more debt. If you can, try to use cash or debit cards instead.

- Get help if you need it. If you are struggling to pay off your debt, there are a number of organizations that can help. You may want to consider talking to a credit counselor or enrolling in a debt management plan.